Embedded finance

Digital transformation, automation between internal business systems and bank accounts

Contact

What is embedded finance?

It is the integration of financial and banking services (such as payments, expenses, account inquiries, investments, etc.) directly into non-financial software platforms, allowing seamless, automated use of services within the main operational platform without needing to switch to a banking app.

Current state of businesses

1

Manual processes

Business operations require the accounting and finance department to reconcile, inquire, and perform tasks manually on internet banking.

2

Fragmented systems

Internal and bank data lacking automated links lead to asynchrony and a lack of real-time information.

3

Operational errors

Errors are most likely to occur during manual operations, with data discrepancies, consuming significant time and resources to rectify.

Core embedded finance solutions

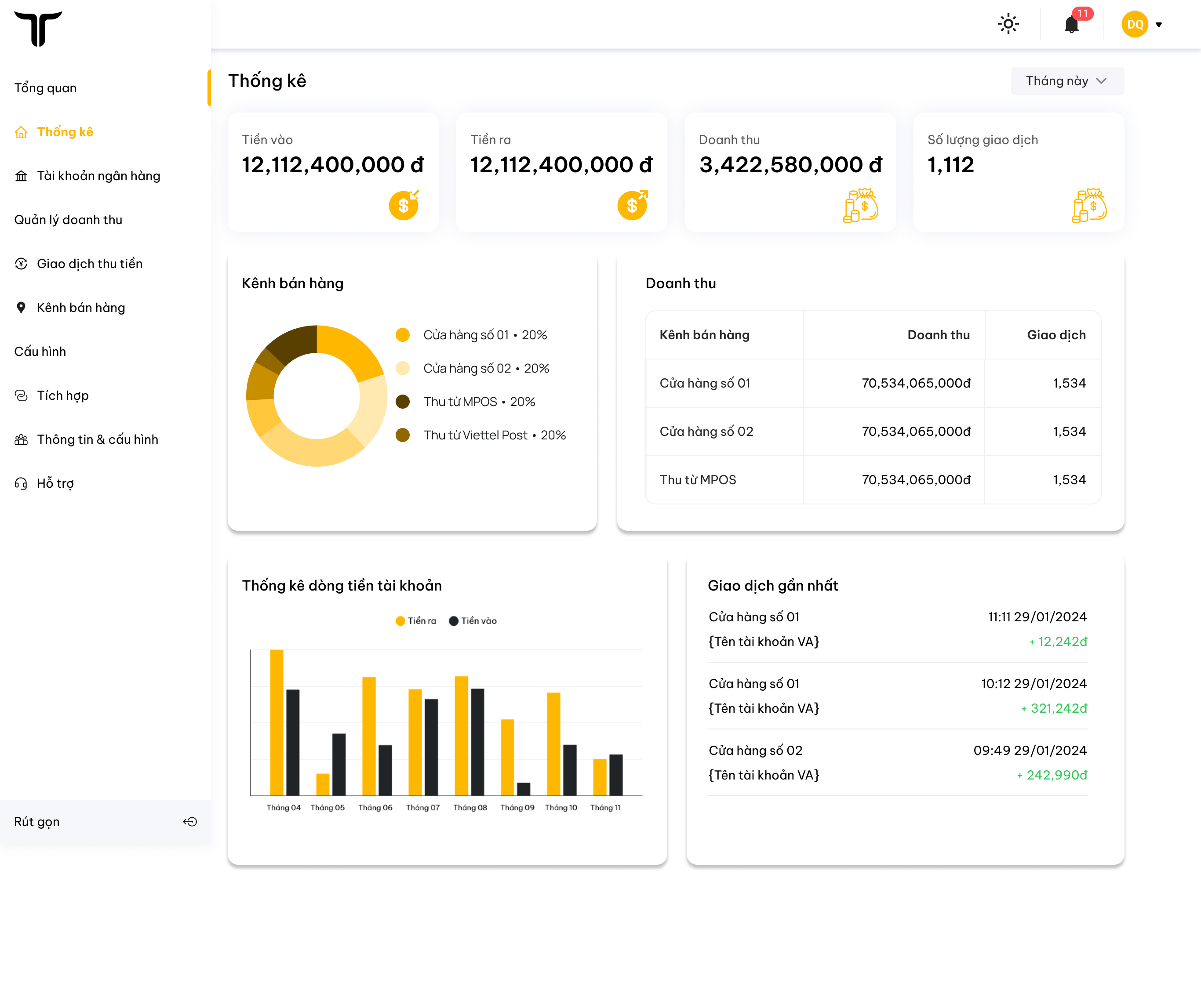

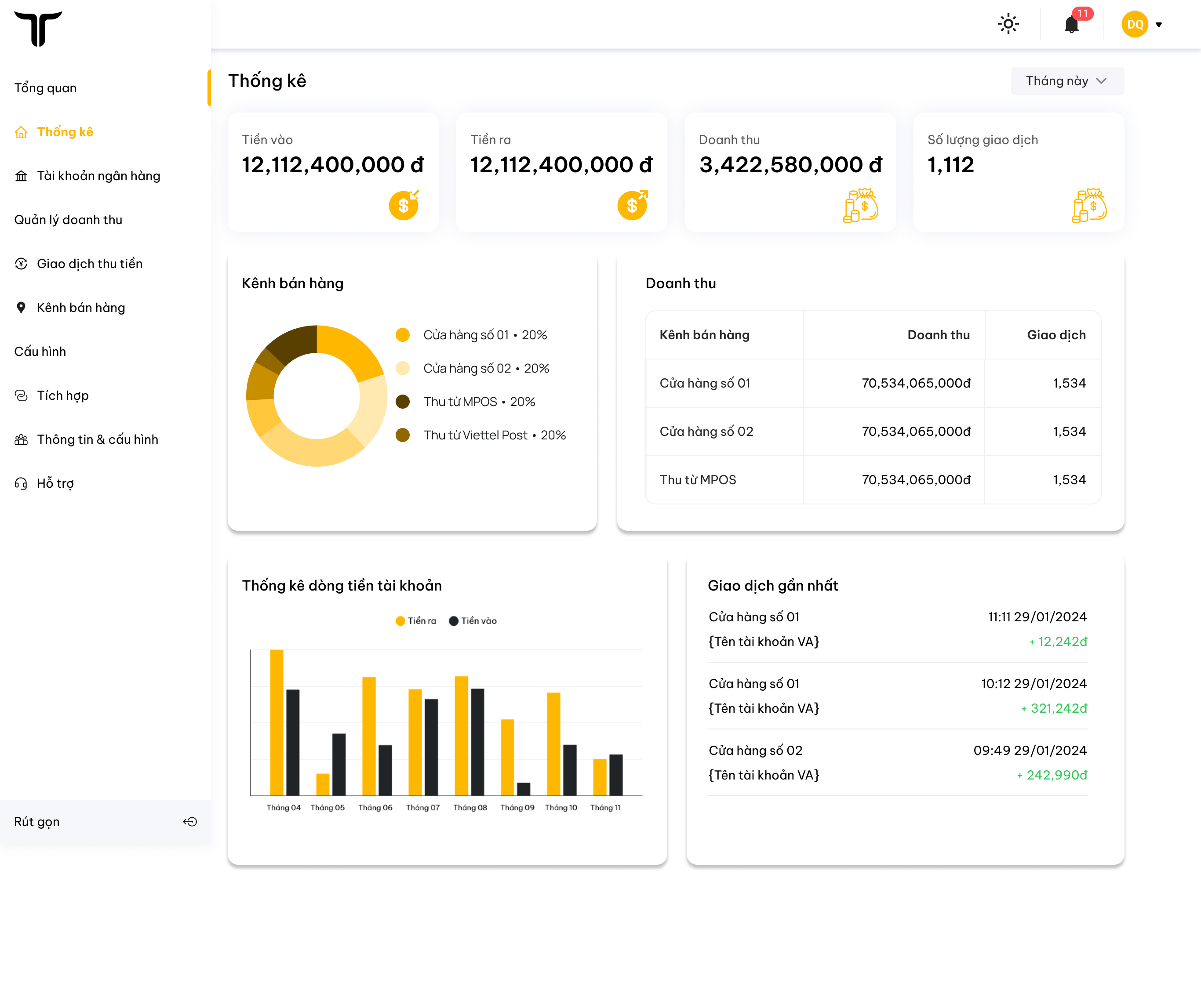

Balance notification

Centralized management of cash inflows and outflows across multiple bank accounts, automatically connecting credit and debit notifications with internal systems.

Virtual account

Segment accounts by business unit, customer, agent, and sales channel. Automatically identify and match revenue to virtual accounts.

Payout

Create disbursement orders from internal software via API connections, enabling businesses to automate processes and standardize data between internal software and bank accounts.

Balance notification

Centralized management of cash inflows and outflows across multiple bank accounts, automatically connecting credit and debit notifications with internal systems.

Use cases

Authorize real-time balance fluctuations for each employee without needing to consult accounting.

Centralized cash flow management across multiple bank accounts.

Connect real-time data with the internal revenue and expense management system.

New transaction

+ 10,000,000

Main account

1,530,000,000

BIDV •• 351

Branch 1

BIDV •• 312

1,200,000,000

Virtual account

A virtual bank account is a sub-account of a main bank account. This technology is provided by Zengi in collaboration with banks, allowing the use of a single bank account while differentiating revenue across multiple sales points, stores, branches, or projects, customers, and orders.

Static virtual account

Each customer (or agent, store, etc.) is assigned a fixed VA code.

This VA can be used multiple times for different transactions.

Dynamic virtual account

This is a VA created automatically for each order or specific transaction.

Each VA is used once, expiring after payment is completed or after a short period.

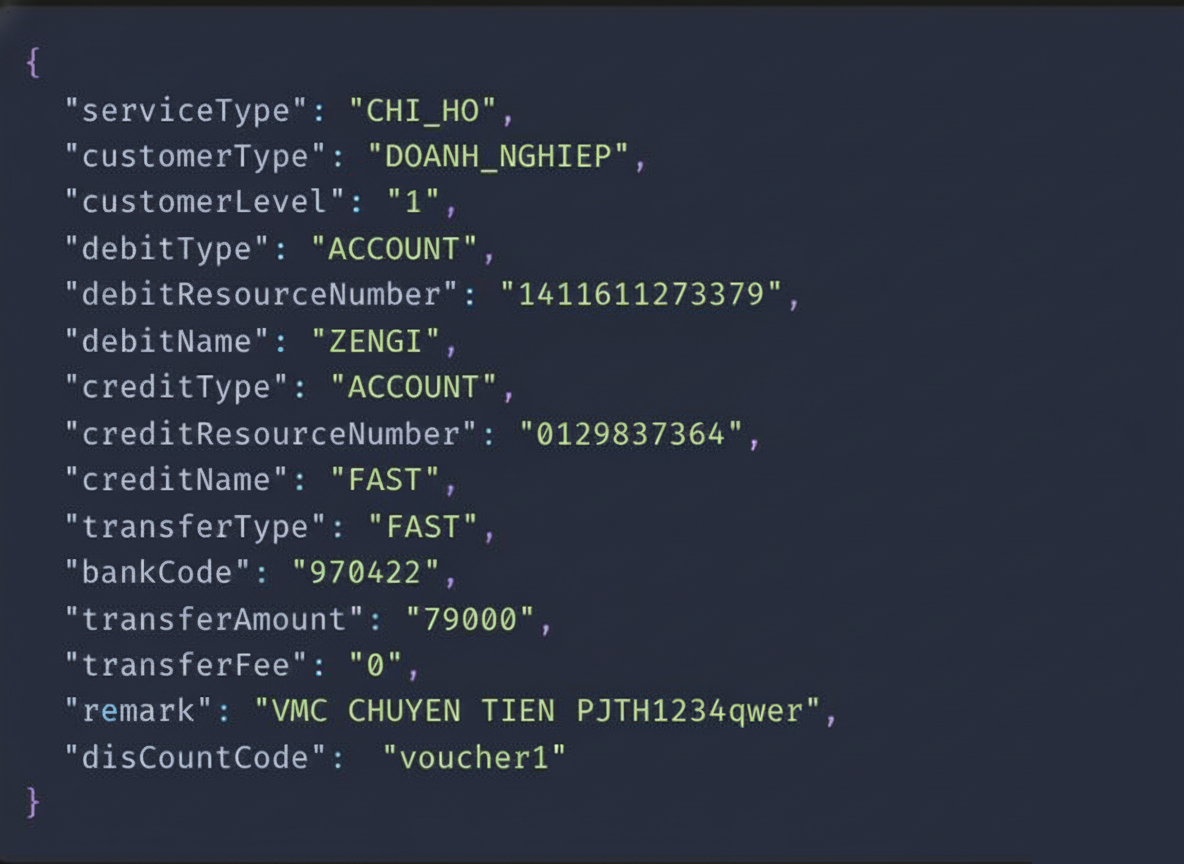

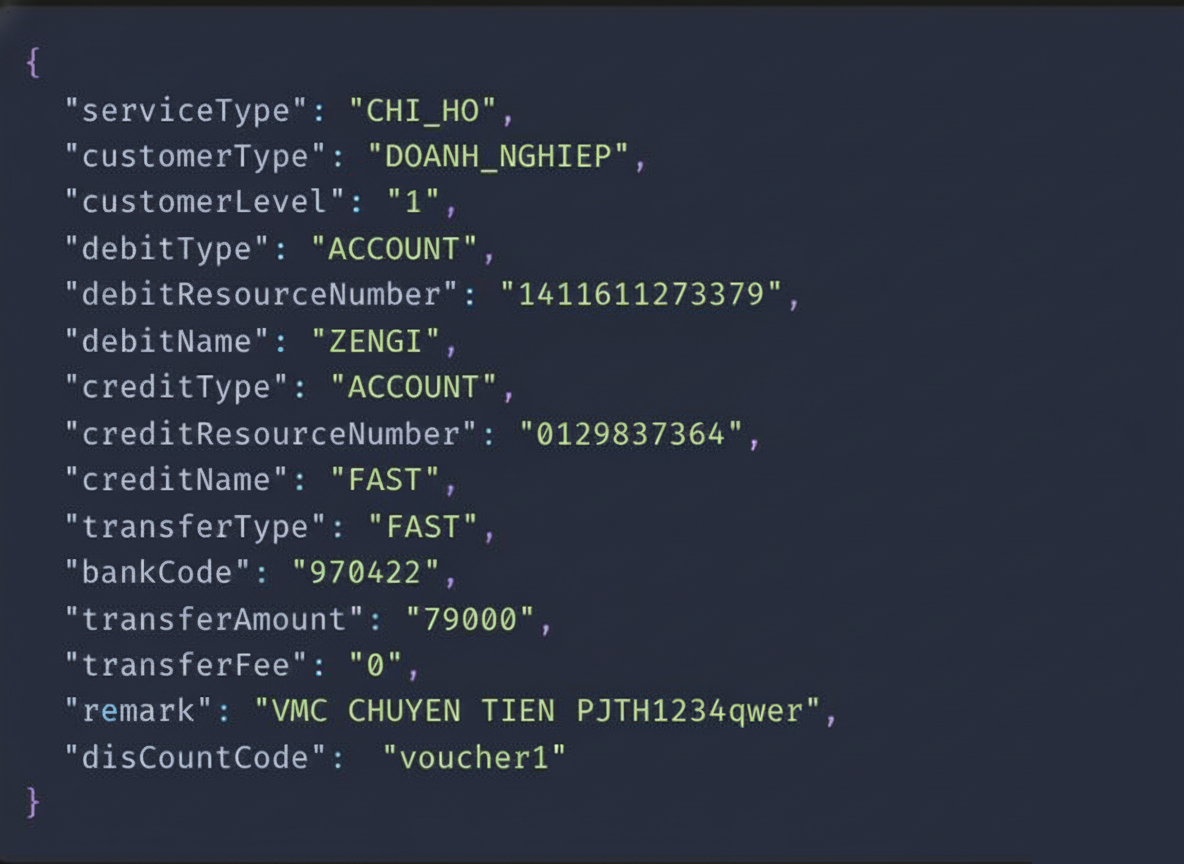

Payout

Create disbursement orders from internal software via API connections, enabling businesses to automate processes and standardize data between internal software and bank accounts.

Flexible approval processes

Approve orders through the internal system with a digital signature.

Approve orders via internet banking.

Use cases

Pay commissions to salespeople, collaborators, and partners.

In-store purchases, refunds.

Deposit and withdraw from service accounts.

Manage purchasing and supplier debts on ERP.

Industry applications

Logistics and delivery

Automatically collect COD payments per order.

Automatic refunds.

Automatic reconciliation with stations and delivery points.

Pay commissions and allowances to drivers.

Education, health, beauty

Automatically charge monthly fees.

Virtual accounts for each student or customer.

Automatic refunds.

Payments to teachers and specialists.

Real estate

Virtual accounts for each room, rental apartment, or building block.

Monthly deposit, rental, and utility fees.

E-commerce

Virtual accounts for sellers.

Automatically distribute commission expenses to sellers and partners.

Automated periodic payments to sellers.

Insurance, pawn, lending

Collect insurance fees per contract using virtual accounts.

Pay compensation.

Track cash flow for debt repayment.

Public service and utilities

Collect fees per contract and receipts using virtual accounts.

Manage multiple levels of collection agents.

Automatically deposit collected funds and deduct service fees automatically.

For software companies.

Extend value connections, digital transformation, and automation for your customers by integrating ERP, CRM, SAAS systems, and bank accounts with Casaflow.

Contact

Company Information

Zengi Joint Stock Company

Tax ID: 0315120727

Address: 64 Ut Tich, Tan Son Nhat Ward, Ho Chi Minh City

Solutions

Company

© Casaflow 2025. All rights reserved.

Embedded finance

Digital transformation, automation between internal business systems and bank accounts

Contact

What is embedded finance?

It is the integration of financial and banking services (such as payments, expenses, account inquiries, investments, etc.) directly into non-financial software platforms, allowing seamless, automated use of services within the main operational platform without needing to switch to a banking app.

Current state of businesses

1

Manual processes

Business operations require the accounting and finance department to reconcile, inquire, and perform tasks manually on internet banking.

2

Fragmented systems

Internal and bank data lacking automated links lead to asynchrony and a lack of real-time information.

3

Operational errors

Errors are most likely to occur during manual operations, with data discrepancies, consuming significant time and resources to rectify.

Core embedded finance solutions

Balance notification

Centralized management of cash inflows and outflows across multiple bank accounts, automatically connecting credit and debit notifications with internal systems.

Virtual account

Segment accounts by business unit, customer, agent, and sales channel. Automatically identify and match revenue to virtual accounts.

Payout

Create disbursement orders from internal software via API connections, enabling businesses to automate processes and standardize data between internal software and bank accounts.

Balance notification

Centralized management of cash inflows and outflows across multiple bank accounts, automatically connecting credit and debit notifications with internal systems.

Use cases

Authorize real-time balance fluctuations for each employee without needing to consult accounting.

Centralized cash flow management across multiple bank accounts.

Connect real-time data with the internal revenue and expense management system.

New transaction

+ 10,000,000

Main account

1,530,000,000

BIDV •• 351

Branch 1

BIDV •• 312

1,200,000,000

Virtual account

A virtual bank account is a sub-account of a main bank account. This technology is provided by Zengi in collaboration with banks, allowing the use of a single bank account while differentiating revenue across multiple sales points, stores, branches, or projects, customers, and orders.

Static virtual account

Each customer (or agent, store, etc.) is assigned a fixed VA code.

This VA can be used multiple times for different transactions.

Dynamic virtual account

This is a VA created automatically for each order or specific transaction.

Each VA is used once, expiring after payment is completed or after a short period.

Payout

Create disbursement orders from internal software via API connections, enabling businesses to automate processes and standardize data between internal software and bank accounts.

Flexible approval processes

Approve orders through the internal system with a digital signature.

Approve orders via internet banking.

Use cases

Pay commissions to salespeople, collaborators, and partners.

In-store purchases, refunds.

Deposit and withdraw from service accounts.

Manage purchasing and supplier debts on ERP.

Industry applications

Logistics and delivery

Automatically collect COD payments per order.

Automatic refunds.

Automatic reconciliation with stations and delivery points.

Pay commissions and allowances to drivers.

Education, health, beauty

Automatically charge monthly fees.

Virtual accounts for each student or customer.

Automatic refunds.

Payments to teachers and specialists.

Real estate

Virtual accounts for each room, rental apartment, or building block.

Monthly deposit, rental, and utility fees.

E-commerce

Virtual accounts for sellers.

Automatically distribute commission expenses to sellers and partners.

Automated periodic payments to sellers.

Insurance, pawn, lending

Collect insurance fees per contract using virtual accounts.

Pay compensation.

Track cash flow for debt repayment.

Public service and utilities

Collect fees per contract and receipts using virtual accounts.

Manage multiple levels of collection agents.

Automatically deposit collected funds and deduct service fees automatically.

For software companies.

Extend value connections, digital transformation, and automation for your customers by integrating ERP, CRM, SAAS systems, and bank accounts with Casaflow.

Contact

Company Information

Zengi Joint Stock Company

Tax ID: 0315120727

Address: 64 Ut Tich, Tan Son Nhat Ward, Ho Chi Minh City

Solutions

Company

© Casaflow 2025. All rights reserved.